my roles

stakeholder management / workshop facilitation / competitor analysis / prototyping / concept validation testing / surveying / visual design

My journey began at Boxer in October 2021.

I was headhunted from Mercury and challenged with leading their design function to bring the founders idea to market - a shopper protection service offered in the customer’s home country to protect their purchases from delivery, faults and authenticity.

When I joined, a huge amount of important progress had already been accomplished but it was fairly obvious from the onset that there was a concerning amount of silos and dysfunction holding Boxer back.

During my 1st year, we worked hard to implement new ways of working and techniques borrowed from design thinking to help us collaborate closer and group around complex problems - both of our potential customers (B2C) of our actual product and our seller partners (B2B).

Come year 2, many of our collaboration challenges were solved but Boxer was still struggling to gain meaningful traction. Although a foreign concept to me, I learned this to be a common occurrence in the startups called ‘Product-Market fit’.

opportunity

How might we bring data into our product-market-fit decision making to unlock scale and growth for Boxer

Discovery & planning

To ensure the initiative's success, we formed a cross-functional team- including the CEO, VPs, and representatives from Sales, Marketing, and Engineering. The Product Design Team along with a Product Owner would lead the effort.

We kicked off with a series of discovery workshops and identified, where I facilitated, and identified four high value customer journeys to validate….

Add on - our most traditional offering, where customers can choose to add Boxer to their individual purchases

Embedded - a model where sellers incorporate the price of Boxer into their margins to offer complimentary to their customers, to increase their conversion rates

Cart level - similar to add on, customers can choose to add Boxer but to their entire order / cart

Interrupt - our most highly visible offering, an step inserted into a customer’s buying journey

Next we crafted our research plan - where my I and my team recommended unmoderated prototype testing combined with surveys, totalling 200 tests across Consumer Electronics and Apparel categories in Australia and the United States.

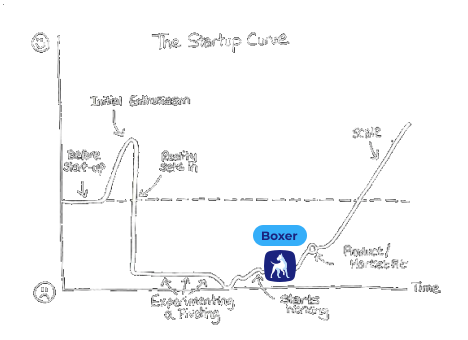

To move at pace, bi-weekly feedback sessions were established and Maze was set as a our tool of choice for consolidating prototype interaction, user feedback, videos and survey data.

With our plan in place, my team set out to design, prototype, recruit, test and analyse results in just 6 weeks - an ambitious goal which would require close collaboration across Boxer.

design & prototype

Our first iterations began as sketches - throwing many concepts for each model into the mix before whittling down our choices to options we considered the strongest , factoring in account the opinions of our SMEs & Stakeholders which had the most chance of success.

Although Boxer had a strong, established brand presence the Design Team decided it beneficial to begin in grayscale wireframes. This decision allowed the ream to prioritise functionality and content over aesthetics, knowing that visual designs could be applied later using our existing design system and brand guidelines.

Working in our weekly cycle, we iterated quickly on each journey - starting with many concepts and reducing down to those we believed to be the strongest while noting assumptions to hone in on during our customer sessions.

During this phase, intriguing idea formed that we ran with….

Could we educate customers about the potential challenges of cross-border shopping?

Emphasising Boxer’s benefits as the solution to shoppers pain points.

As our working group committed to final design for each journey, prototypes for each were created and then loaded & configured in Maze.

In parallel, my team used Askable to recruit participants - 200 in total across two countries, a mixture of Males & Females from 65 - 19 years who who had purcahsed from overseas at leat 4 times in the past year.

results

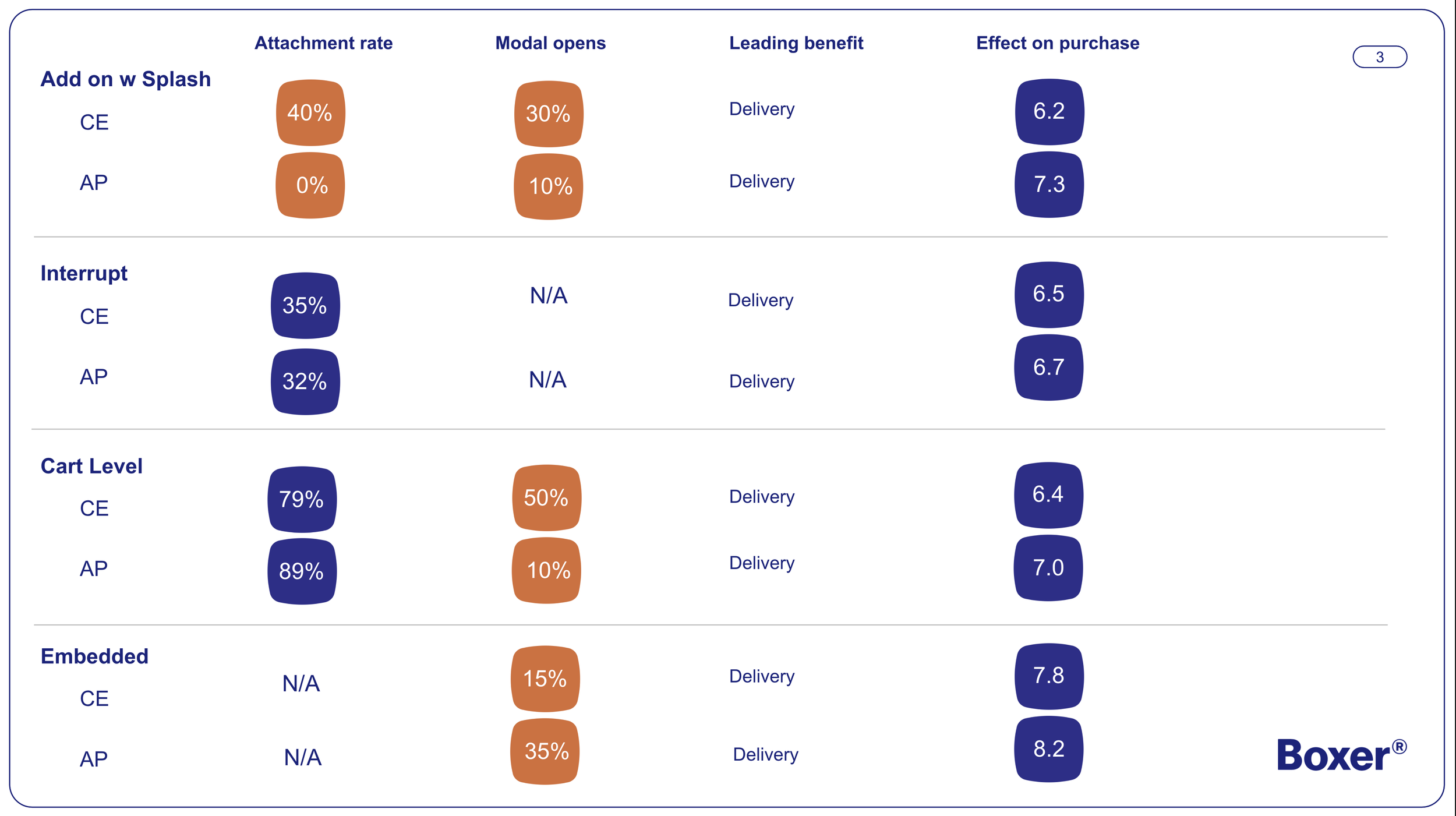

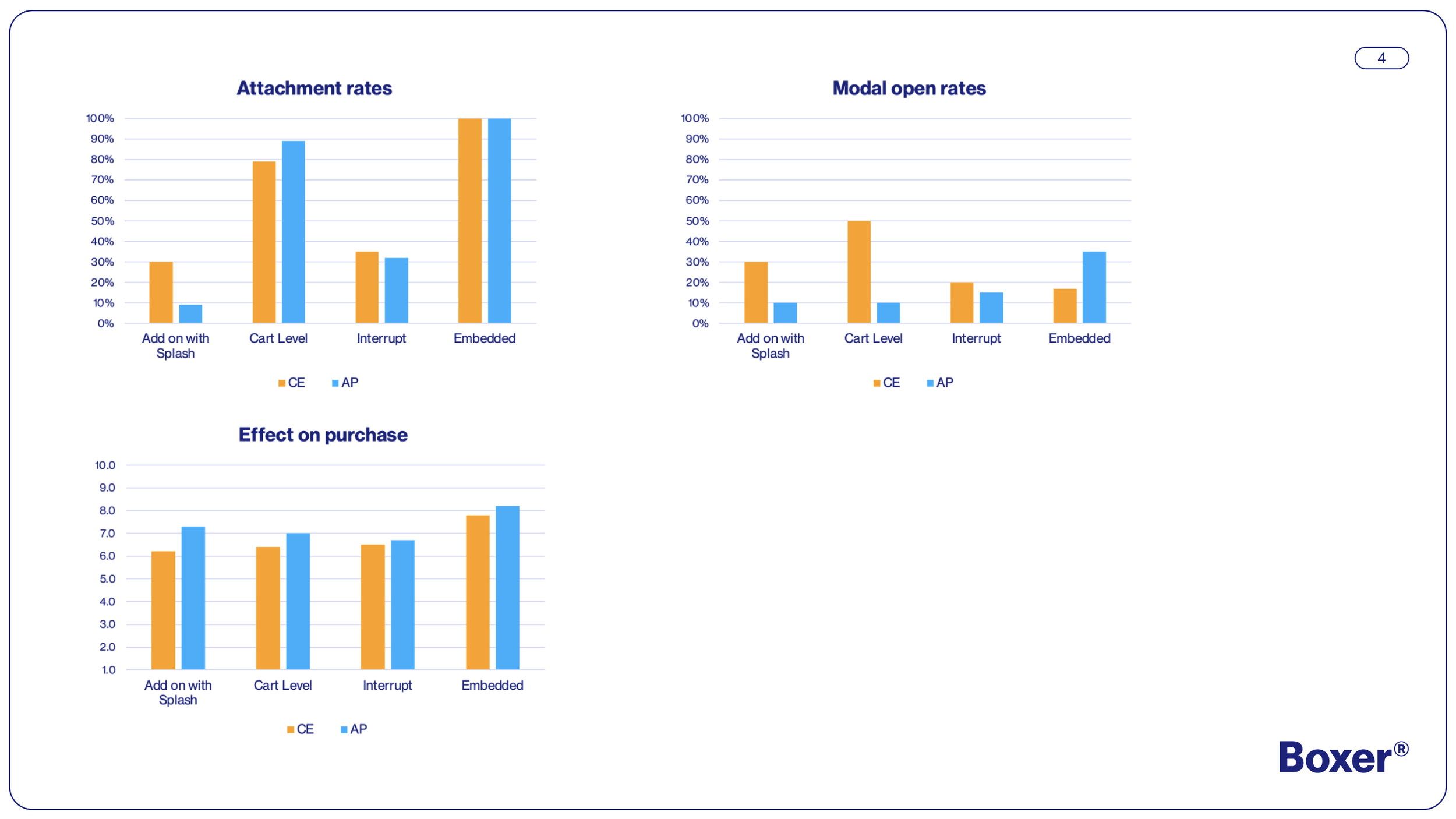

Our research plan created during our planning stage called for us to report on valuable metrics including…

Inclusion of Boxer (conversion)

interaction rates with pop-up modals (modal opens)

General effect of Boxer on purchase (propensity to purchase)

Overall customer effort score (CES)

Based on these, my team and I began collating results both within & across journeys to help the wider group incorporate into our future decision making. We also utilised ChatGPT to speed up identifying common themes, sentiment and general data analysis.

A detailed report was generated to create discussion which can be accessed here and below are some examples of our high level findings.

Overall scorecard for each journey

Comparison graphs of metrics across journeys

conclusion

We have already incorporated some of our findings into our current live offerings and are seeing positive signs of our success metrics - indicating a strong impact on our product market fit.

Next iterations are underway based on customer feedback, while we prioritise which journeys & models to ship & research further with our B2B seller partners.

We know there's always more we can do to make things better. In design, there's always more work to be done.